What is Education?

Central Goods and Services Tax Act, 2017 nowhere defines the meaning of Education. The Supreme Court in its decision to “Loka Shikshana Trust vs. Commissioner of Income Tax” has defined Education as the “Process of training and developing knowledge, skill and character of students by normal schooling.” It is necessary that the role of any school or educational institution extends to teach good character and other skills and not restrict by providing only the technical education.

Taxing Education – Right or Wrong?

Article 21A of Constitution of India provides for free and compulsory education of all children in the age group of six to fourteen years as a Fundamental right in such a manner as the State may, by law, determine. While basic and elementary education is a Constitutional right, commercialisation of education is becoming an undisputable reality nowadays. So, allowing a blanket exemption for all educational institutions might end up being a profiteering measure.

Education – Whose Responsibility?

The Indian Constitution delineates items of common importance into Central List, State List and Concurrent List. Entries under the Central List is vested with the Central Government, State List under the State Government and those under the concurrent list is the joint responsibility of the Central and State Government. Education is listed under the Concurrent list and hence all promotional measures relating to education has to be taken by both the Central Government and State Government. With respect to the University level education in India, the Central Government is responsible for funding grants to Universities Grants Commission (UGC), establishing Central Universities, declaring “deemed institution” status to Universities based on the UGC recommendations. The State Government is vested with the responsibility of establishing State Universities and colleges, providing planned grants for development and non-planned grants for its maintenance. Coordination of Central and State Government can be witnessed in the activities of Central Advisory Board of Education (CABE), wherein the progress of education is reviewed, implementation of various education policies by Central and State Government is appraised from time to time. According to the Economic Survey FY 2017-18, the expenditure on education in India has increased in terms of absolutes to R4.41 lakh crore in 2017-18 BE as compared to R3.31 lakh crore in FY 2012-13 (Figure 1). However, if the expenditure trend on education is evaluated keeping in mind the Total Expenditure allocation of the Central Government, it is a hard actuality that there is a drop from 11.61% to 10.03% from FY 2012-13 to FY 2017-18.

Registration Requirements–Educational Institution

According to Section 22 of CGST Act 2017, any person having an Aggregate Turnover of not less than Rs 20 lakhs in a financial year is liable to take registration under GST. This turnover limit is reduced to Rs 10 lakhs if the person is making his taxable supply from any of the special category states [i.e. Assam, Arunachal Pradesh, J&K, Himachal Pradesh, Uttarakhand, Manipur, Mizoram, Sikkim, Meghalaya, Nagaland or Tripura].

Reverse Charge u/s. 9(4) of CGST Act, 2017

Section 9(4) of CGST Act, 2017 mandates that liability under reverse charge shall apply and tax shall be paid by registered persons receiving taxable supplies from unregistered suppliers. This provision being a measure affecting small businesses faced severe criticisms and is temporarily suspended till 30th June 2018 based on various representations. This retrograde provision u/s. 9(4) of CGST Act, 2017 would force registration of every business even if the turnover does not exceed threshold limit – the reason being large businesses would be interested only in businesses with the registered persons. Since unregistered suppliers would add to the already burdened large enterprises tax payments and return formalities.

Educational Institution-Constitution

To restrict the profit making objective of persons running educational institutions and to promote social welfare, it is framed that any organisation operating as an educational institution can be constituted only as a Society or a Trust or a Section 8 Company. It cannot be opened in any other form.

i. Society: Society is generally an association of persons united together by mutual consent to deliberate, determine and act jointly for some common purpose. All societies are generally governed by Societies Registration Act, 1860. ii. Trust: The concept of ‘trust’ flows from the faith of one person in another person. If a person, out of free will, entrusts his property to the care of another person for a specific purpose or period, that other person has to uphold the trust reposed in him. All Trusts are governed by Indian Trust Act, 1882. iii. Section 8 Company: A company with limited liability formed for “promoting commerce, art, science, religion, charity or any other useful object,” with no profits objective. All Section 8 Companies are governed by Companies Act, 2013.

Nowadays, businesses have the panache to run educational institutions or adopt the functioning of an educational institution after introduction of Corporate Social Responsibility (CSR) provisions. In such a case, it is important the Accounting Standard -17, Segment reporting is followed and the reporting of operations of educational institution is clearly demarcated from the business operation and reporting is made as a separate segment.

Business Flow:

Though educational institutions are not meant to be profit making, to self-finance itself there are certain receipts that acts as a source to fund the expenditure needed to achieve its objective. Compilation of common receipts/expenditures in any educational institution has been listed below. Receipts: Any educational institution has its main receipts from its students in the form of tuition, admission, transport, hostel mess fees, etc. They also receive donation funds and grants from individuals/ government or non-government institutions for general or specific purpose. In case of Universities/ colleges, the faculties are also engaged in providing commercial training or research activities to Organisations apart from the regular training provided to students. Expenditure: Payment of monthly emoluments, retirement and terminal benefits to Teachers and staffs employed by the educational institution constitutes almost 50% of the total expenditure of any educational institution. Apart from that, there are other expenses incurred and paid to external entities. They are generally in the form of payment for infrastructure and maintenance facilities, legal and audit, books and stationery, transportation for students, faculty and staff, etc.

Taxability of Supplies BY Educational Institutions

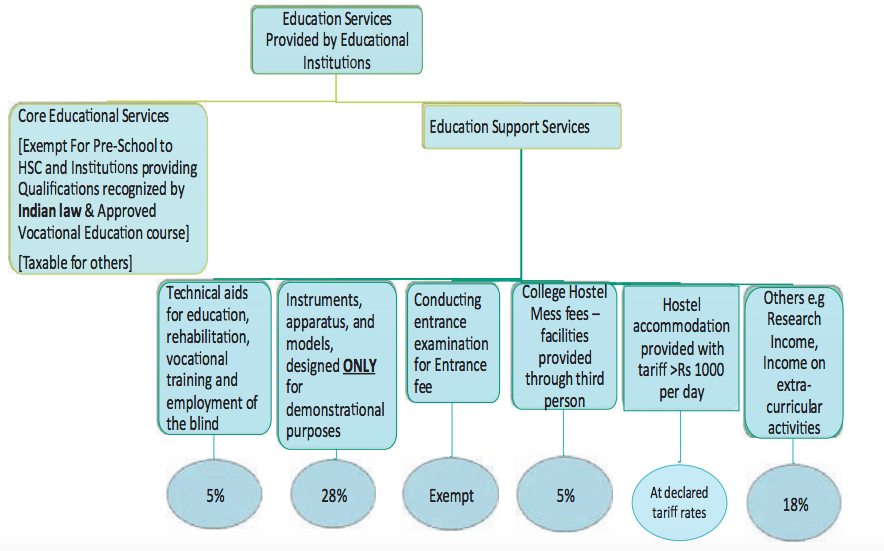

Notification no. 12/2017 – Central Tax rate dated 28th June 2017 and Notification no. 2/2018 – Central Tax rate dated 25th January 2018 extensively discusses on the taxability of services provided by Educational Institutions. To underline the importance of providing core educational services and to keep up the importance of the constitutional right of right to education, core educational services provided by the institutions providing the following are fully exempt:

- Pre-school to Higher Secondary School 2. Qualifications recognised by Indian law 3. Approved vocational educational course

It is important to note that core education services with respect to school education irrespective of whether it is recognised by Indian law or not is exempt. For instance, Services provided by international schools giving international certifications such as International Baccalaureate (IB) is exempt. The requirement of the qualification being recognised by Indian law arises only after school education. Hence, if a college course leads to a qualification not recognised by Indian law, the fees received by the college in that respect is fully taxable. Educational Institutions also provide support services in addition to the core educational services. Such support services either are in addition to or aid to the core educational services provided by such institutions. Any fees collected for conducting entrance examination by any educational institution, be it school or a college is completely exempt.

Specific notifications/clarifications have been provided with respect to the Hostel mess fees and hostel Accommodation fees.

Hostel mess fees:

College running a mess of its own accord for its students is fully exempt, since it is in the nature of a composite supply–wherein the Principal supply is provision of education and the consequently mess fees collected is a supply that is naturally bundled to the principal supply. Circular No. 28/2/2018– GST [F.No. 354/03/2018] jointly read with the Corrigendum issued in this regard clarifies that mess fees collected by a college running a mess through a third party is liable for GST at 5% without any eligibility to Input tax credit.

Hostel accommodation fees:

No GST is chargeable on Annual subscription/fees charged as lodging/boarding charges by educational institutions from students for hostel. However, to create a tab on the fees collected as hostel accommodation, general provisions as applicable to a hotel, inn, guest house, club or campsite, by whatever name called, for residential or lodging purposes is applicable for educational institution. If the declared tariff charged by the educational institution for hostel accommodation is less than Rs 1000 per day, then such fees is fully exempt. Otherwise, it is taxable at the respective rates as applicable to the declared tariffs.

Other fees:

Any other fees collected by an educational institution like additional fees for extra-curricular activities to students or any income earned from private enterprises for conducting some research work, etc. is taxable at 18% GST. Provision of technical aids for education, rehabilitation, vocational training and employment of the blind will attract 5% GST. Any Supply by an educational institution of Instruments, apparatus, and models, designed only for demonstrational purposes will attract 28% GST.

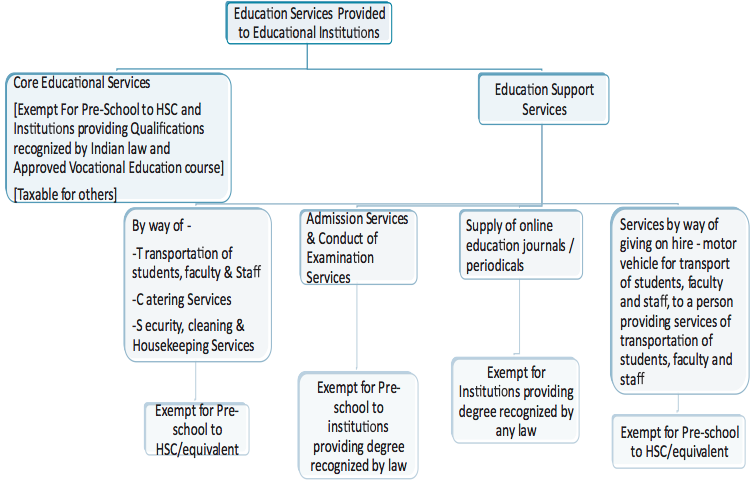

Taxability of Supplies to Educational Institutions

Any supply provided by students, faculty, or staff to an educational institution if it is in the nature of core educational services, such supplies are completely GST free if it is provided by an institution providing the following:

- Pre-school to Higher Secondary School 2. Qualifications recognised by Indian law 3. Approved vocational educational course

In case of any supply to an educational institution of a service which is not in the nature of core educational service, GST rates as applicable to the respective goods/services provided to other than educational institution applies to an educational institution also. However, 100% exemption is provided for certain services rendered to educational institutions. For instance, admission services and services provided to aid the conduct of examination to an educational institution is exempt for all those providing preschool to higher secondary school education and institutions providing degree recognised by Indian law. It is important to note that the following exemptions are restricted only to educational institutions providing Pre-school to Higher Secondary School education:

Any service provided to an educational institution by way of transportation of students, faculty and staff. Services provided to an educational institution, by way of catering, including any mid-day meals scheme sponsored by the Central Government, State Government or Union Territory. Services by way of Security, cleaning and housekeeping services provided to an educational institution.

Generally, GST on vehicle hire charges is at the same rate as vehicles. However, by taking a step forward to incentivise the educational institutions, exemption from GST is provided for vehicle hire charges paid by a third party providing services of transporting students, faculty or staff to an educational institution. This exemption is restricted for services provided by such third party to an educational institution providing pre-school to Higher secondary school education or equivalent and is not available for institutions providing college education. Just like exemptions being available only for school education, any revenue generated from supply of online education journals or periodicals by a college providing qualification recognised by Indian Law is fully exempt. This exemption is not extended to institutions providing school education.

Composite Supply and Mixed Supply:

There may be two or more supplies by an educational institution, and there is a possibility of both the supplies being taxable, or both being non-taxable, or one being taxable and the other being non-taxable. In such a case, there needs to be an evaluation as to whether taxability of one supply will affect the taxability status of the other supply since both are provided together. In case there are two or more supplies – the grouping can be either under Composite supply or mixed supply or it can be regarded as two separate supplies. Let’s understand the meaning assigned to Composite supply and Mixed supply under the GST Act. Section 2(30) of the CGST Act, 2017 defines Composite supply. A supply will be regarded as a ‘composite supply’ if the following elements are present:

a. The supply should consist of two or more taxable supplies b. The supplies may be of goods or services or both c. The supplies should be naturally bundled d. They should be supplied in conjunction with each other in the ordinary course of business e. One of the supplies should be a principal supply

The tax treatment of a composite supply would be as applicable to the principal supply. Section 2(74) of the CGST Act, 2017 defines Mixed Supply. A supply will be regarded as a ‘Mixed Supply’ if the following elements are present:

a. The supply should consist of two or more individual supplies b. The supplies may be of goods or services or both c. They should be supplied in conjunction with each other d. There should be a single price assigned to the package e. Such supply does not constitute a composite supply.

The tax rates applicable in case of mixed supply would be the rate of tax attributable to that one supply, which may be either goods or services, which suffers the highest rate of tax from amongst the supplies forming part of the mixed supply. Following are certain scenarios of two/more supplies in an educational institution and the possible treatment of taxation:

Place of Supply

Goods and Services Tax being a consumption based destination tax, accrues all tax revenues to the state where the goods/services are finally consumed. Place of supply forms a significant part of determining the nature of supply. If the location of supplier and Place of supply is in the same state, the said supply is an Intra-state supply. If the location of supplier and place of supply is not in same state or Union territory, then the said supply is Inter-state supply. The place of supply provisions for goods and services in case of other than imports/exports and imports/exports are outlined separately in Section 10 and 11 for goods and Section 12 and13 for services respectively.

Inter-location Services

Hitherto, educational institutions as Service providers were taking Centralised Registration in the service tax era. Under GST, educational institutions will have to take Multiple State wise Registration as against Centralised Registration. Let us see if this has an impact on the input tax credit mechanism. Scenario 1: A senior professor in his consulting capacity from Bangalore delivers a lecture to the students based in IIT Chennai campus through webex. Since the Location of supplier of service, i.e. professor’s location is Bangalore and the Place of Supply i.e. the service is being consumed by the Students based in Chennai-it is a perfect case of Inter-state supply and hence, Integrated Goods and Services tax would be charged in the bill by the Consultant and hence, there is no blockage of Input tax credit for IIT Chennai. So when Place of Supply is same as the State where Registration is obtained by the educational institution, there is no blockage of Input tax credit. Scenario 2: Consider an example of a walk-in job interview is organised and the event organising expenses are jointly by IIT Chennai, MIT Chennai, Accenture and Reliance in Vivanta by Taj, Bangalore. In this case, the location of supplier of service i.e. Vivanta by Taj is Bangalore. The place of supply is also Bangalore. So here, place of supply is not in the same state where registration is obtained by the educational institution (IIT Chennai), hence the SGST charged in the invoice by Taj cannot be utilised by it. There is a blockage in input tax credit flow. Above is an attempt to cover the distinctive points that an educational institution is facing on Goods and Services Tax enactment in India. It is interesting to note that though most of output supplies provided are exempt, exemption available to the input supplies are continuing as in the pre-GST era. It is important that Educational institutions and the educationists should aim to build the capacities of the spirit of inquiry, creativity, entrepreneurial and moral leadership among students and become their role model. It is important that all educational institutions believe in the saying of Jacque Fresco, an American futurist thereby making education affordable to all – “when education and resources are available to all without a price tag, there will be no limit to the human potential”.